Bear River Mutuals’ Most Frequently Asked Questions

Below are some basic questions and answers that might help you answer your questions more quickly.

Car Insurance

If you need to add or remove drivers from your insurance policy, the first step is to contact your agent. They will guide you through the process and ensure that any necessary changes are made to your policy.

When adding a new driver to your policy, it’s important to have certain information readily available. This includes the driver’s full name, date of birth, and driver’s license number. If the driver is not living with you, such as if they are away at school, having their temporary address on hand can also be helpful.

To find your agent’s contact information, you can visit the landing page after logging in to our Customer Site, refer to your policy documents, or search the agency list provided. Your agent is the best resource for making any modifications to the drivers insured on your policy.

Whether you need to add a new driver or remove an existing one, your agent will be able to assist you in making the necessary changes. They have the knowledge and expertise to ensure that your policy accurately reflects the drivers covered under your insurance.

Reach out to your agent today to discuss any changes you need to make regarding the drivers on your policy. They are here to provide you with personalized assistance and help you navigate the process smoothly.

If you need to add or remove vehicles from your insurance policy, the first step is to get in touch with your agent. They will assist you in making the necessary changes to your policy and ensure that your coverage accurately reflects your vehicle lineup.

When adding a new vehicle to your policy, it’s important to have certain information on hand. Your agent will need the 17-digit vehicle identification number (VIN), the date you acquired or sold the vehicle, and any details about a lienholder if you have a loan on the vehicle.

To locate the VIN number, you can refer to the bill of sale or registration documents. Alternatively, you can find it by looking at the end of the dashboard through the bottom corner of the driver’s side windshield from the outside of the vehicle. Another option is to open the driver’s door and locate a sticker inside the vehicle that displays the VIN and other manufacturer information. In many cases, there will be a barcode above or below the text version of the VIN.

To find your agent’s contact information, you can visit the landing page after logging in to our Customer Site, refer to your policy documents, or search the agency list provided. Your agent is the best resource for adding newly acquired vehicles to your policy and ensuring continuous coverage.

It’s important to note that your existing policy typically provides up to 14 days of coverage (subject to policy terms) for newly acquired vehicles. However, it is recommended to add them to your policy as soon as possible to ensure uninterrupted coverage. Waiting does not provide any advantage, as coverage will be backdated to when the vehicle was acquired to meet Utah insurance requirements.

Reach out to your agent today to discuss any changes you need to make regarding the vehicles on your policy. They are here to provide you with personalized assistance and help you navigate the process smoothly.

Finding your proof of insurance card, also known as your insurance identification card, is quick and easy. Simply log into our Customer Site, and you will have access to your insurance card in a printable format. Once you have printed the card, you can keep it in your vehicle for convenient access whenever needed.

If you encounter any difficulties while accessing the Customer Site, please don’t hesitate to reach out to your agent directly or give us a call at 801-267-5000. We are here to assist you and can provide additional support by mailing, emailing, or texting you a copy of your insurance card.

It’s important to note that in Utah, electronic insurance cards are considered valid proof of insurance. This means you have the option to keep a digital copy of the card on your phone and present the image to authorities when requested. If you prefer not to print and store a physical copy, keeping a digital copy on your phone can be a convenient alternative.

We understand the importance of having your proof of insurance readily available, whether in print or digital format. Rest assured that we are committed to providing you with easy access to your insurance card and are here to assist you in any way we can.

At Bear River Mutual, all insurance policies are obtained through independent agents who represent our company. To receive a quote, you can reach out to any agency that represents Bear River Mutual. Finding an agent is a simple process. You can easily search for an agent near you by using our online search tool.

We understand that getting an auto insurance quote is an important step in protecting your vehicle and ensuring your peace of mind. Our network of independent agents is ready to assist you in finding the right coverage options for your specific needs and budget. Don’t hesitate to connect with an agent who can guide you through the quote process and address any questions or concerns you may have.

To begin your journey towards obtaining an auto insurance quote, please use our convenient agent search tool on our website. We look forward to helping you secure the insurance coverage that meets your requirements.

When we talk about lower cost or lower premium, we are referring to the amount we need to pay for coverage. If you want to reduce this amount without making changes to your coverage, such as limits, vehicles, or deductibles, the best way is to earn a larger claim-free discount.

At Bear River Mutual, we highly value customers who rarely make claims, and we provide discounts that increase over time as you continue to maintain a low claims frequency. Earning a larger claim-free discount is a great way to lower your insurance costs while still maintaining the same level of coverage.

It’s important to note that not every claim will affect your claim-free discount, so it’s best to check with your agent for specific details. However, if your discount is reduced, it may feel like your rate has increased. On the other hand, earning a larger discount will make it feel like you have a lower rate because it reduces the amount you need to pay.

To explore other ways to earn discounts, including bundling your policies like homeowners insurance, please consult your agent. They can provide you with more information and help you find additional ways to save on your insurance costs.

We understand the importance of finding ways to save on your car insurance expenses. Our team is here to support you in identifying the best strategies for lowering your costs while still maintaining the coverage you need. Don’t hesitate to reach out to your agent for personalized advice and assistance.

At Bear River Mutual, deductibles only apply to comprehensive and collision coverage in our automobile insurance policies. These coverages protect you financially in specific situations, and here’s a simple way to understand them:

- Comprehensive coverage: This type of coverage provides financial protection against events that are mostly beyond your control, such as a stolen vehicle or a tree falling on your car.

- Collision coverage: This coverage offers financial protection for incidents that typically result from driver error, even if it’s the fault of the other driver.

In both cases, the deductible is the amount that you, as the insured, would need to pay if you experience a covered loss that requires a deductible. We would then cover the remaining expenses up to the applicable limit(s) stated in your policy. For example, if the covered expenses amount to $2,500 and you have a $1,000 deductible, you would be responsible for paying $1,000, and we would cover the remaining $1,500.

Collision deductibles are one reason why vehicle owners with “full coverage” often choose to work with the other driver’s insurance company if the other driver is at fault in an accident. While your policy may cover the damage, you would still need to pay the deductible if you file a claim against your policy. If we agree that the other driver is responsible, we would work with their insurance or the driver directly (if they don’t have insurance) to try to recover your deductible. However, it’s important to note that there is no guarantee of success, and the recovery process duration is difficult to predict.

Understanding deductibles is crucial in managing your automobile insurance coverage. If you have any further questions or need clarification, please don’t hesitate to reach out to us. We are here to assist you in navigating your policy and ensuring that you have a clear understanding of how deductibles work.

When it comes to choosing the right insurance coverage for your car, there are several factors to consider. These factors include the type of vehicle you drive, the number of people you expect to have in your vehicle, and your financial situation. It is important to regularly review and adjust your coverage as your circumstances and the world around you change.

At Bear River Mutual, we understand the importance of finding the appropriate coverage for you and your family. That’s why your independent Bear River Mutual agent is available to assist you in determining the best coverage options that meet your specific needs.

Whether you are an existing customer, interested in exploring other options, or simply seeking another opinion, we encourage you to consult with us at no cost or obligation. Our team is here to help you make informed decisions about your insurance needs. We will provide guidance, answer any questions you may have, and ensure that you have the coverage that aligns with your unique circumstances.

Your peace of mind and protection are our top priorities. Please don’t hesitate to reach out to us for personalized assistance and support with your car insurance coverage.

In Utah, it is a legal requirement to maintain no-fault (or liability) insurance on all passenger cars and trucks for the entire registration period. The Utah State Legislature has established minimum liability limits that insurance companies operating in the state must adhere to for motor vehicle insurance policies.

As a responsible driver and vehicle owner in Utah, it is your responsibility to ensure that any vehicle you drive in the state is adequately insured. It is also important to note that insurance companies offering motor vehicle insurance policies in Utah must provide coverage that meets or exceeds the mandatory minimum limits.

Driving without insurance or allowing your insurance to lapse is considered a Class B misdemeanor in Utah. This offense can result in fines, as well as suspensions of your license and vehicle registration. Restoring your driving privileges can also be quite expensive. Additionally, if you have a loan on your vehicle, your lender likely has insurance requirements that must be met. Failure to meet these requirements may result in additional charges for you.

Complying with insurance requirements in Utah is crucial to avoid legal consequences and financial hardships. It is essential to ensure that your vehicle remains properly insured at all times. We recommend consulting with your insurance provider to understand the specific coverage limits and obligations that apply to your situation.

By adhering to the insurance requirements and maintaining appropriate coverage, you can drive with peace of mind, knowing that you are complying with the law and protecting yourself financially in the event of an accident or other unforeseen circumstances.

References: Utah Division of Motor Vehicles, Vehicle Insurance Requirements | Utah State Legislature, 31A-22-304, Motor vehicle liability policy minimum limits.

Coverage for windshield damage is provided if the vehicle with the damage has comprehensive coverage. If your vehicle has comprehensive coverage, you may be eligible for coverage for repairable windshields at no additional cost. However, windshields that require replacement are subject to the comprehensive deductible specified on your policy for the specific vehicle. The amount we will pay towards a replacement is based on the remaining charges after the deductible has been satisfied.

If you have windshield damage and need assistance, please reach out to us at (801) 267-5001 or (800) 925-5177, option 3. By contacting us, you will be directly connected to one of our auto glass claim associates who will guide you through the claim process and provide the necessary support.

Rest assured that our team is here to assist you in resolving your windshield damage claim promptly and efficiently. We understand the importance of clear visibility and safety while driving, and we strive to provide the necessary coverage and support to address your windshield repair or replacement needs.

Selecting the right deductible amount is a personal decision that depends on your financial approach. Even if two individuals have similar circumstances, they may have different preferences when it comes to deductible options. Your agent is available to help you understand the advantages and disadvantages of various deductible amounts.

In general, opting for a higher deductible will result in lower insurance premiums, but it means you will need to pay more out-of-pocket if you file a claim. Conversely, choosing a lower deductible will lead to higher premiums, but you will have a smaller amount to pay if you need to make a claim. Consider how much you are comfortable paying in the event of a claim.

Regardless of the deductible you choose, it is important to discuss with your agent the potential impact of filing a claim, particularly if the cost is close to your deductible. Many of our customers have earned significant discounts by refraining from filing claims. If a claim is paid, it could affect the base price of your coverage at your next renewal, potentially resulting in a reduction or loss of the claim-free discount. Additionally, insurance companies consider claims history when determining pricing. Filing a small claim might have a larger cost impact than expected if you decide to switch insurance providers later, which may not be as advantageous. This applies to both our current customers and those considering switching to Bear River Mutual.

For personalized advice on selecting a deductible and understanding the potential implications of filing a claim, we encourage you to consult with your agent. They are equipped to provide you with the specific guidance you need based on your individual circumstances.

At Bear River Mutual, we understand the importance of making informed decisions about your deductible. We are here to assist you in navigating your options and ensuring that you have the right coverage for your needs. Please reach out to your agent for personalized assistance and advice.

If you have an older car that is fully paid for and you are not concerned about minor cosmetic damage, nearing the end of its lifespan, or has a low market value, you may consider not purchasing comprehensive coverage as a way to reduce your insurance premiums. However, it is important to keep in mind that if you do opt for comprehensive coverage, the coverage amount will be based on the market value of your vehicle. Additionally, any claims, except for windshield repairs (excluding windshield replacement), will be subject to the deductible you have chosen.

Deciding whether to have comprehensive coverage for your older car involves evaluating factors such as its current value, your financial situation, and your personal risk tolerance. If the potential cost of repairs or replacement outweighs the savings on insurance premiums, comprehensive coverage may still be worth considering. We recommend discussing your specific situation with your agent to determine the best course of action.

At Bear River Mutual, we are here to provide guidance and help you make informed decisions about your insurance coverage. Feel free to reach out to us for further assistance and support in determining the right coverage options for your older car.

To receive an insurance quote, we kindly ask that you provide the following information as a minimum requirement:

- Name and date of birth: Please provide the name and date of birth for each driver who will be included in the policy.

- Vehicle Identification Number (VIN): If available, please provide the 17-digit VIN for each vehicle you wish to insure. If you don’t have the VIN numbers, you can provide the year, make, model, and trim level of the vehicles.

In addition to the minimum requirements, your agent may ask for additional information to ensure an accurate quote. It’s important to note that this information will also be necessary if you decide to proceed with purchasing insurance from us. The additional information may include:

- The driving history and driver license number for each driver.

- The name of the lienholder (if applicable) for any vehicles that have a loan.

- The 17-digit VIN for each vehicle you want to insure (if not previously provided).

- Any existing damage to a vehicle that needs to be disclosed.

- If not all drivers reside in your home, such as a student away at school, it would be helpful to have the additional address(es) available.

By providing this information to your agent, we can offer you the most accurate quote possible. Our goal is to ensure that you receive a quote tailored to your specific needs and circumstances.

If you have any further questions or require assistance in obtaining a car insurance quote, please don’t hesitate to contact us. Our team is here to help and provide you with the necessary information to make an informed decision.

Liability coverage is an essential part of your insurance policy that protects you in case of injury or damage to others. Here is an overview of the different types of liability coverage:

- Bodily Injury Liability: This coverage helps pay for medical expenses if you cause an accident that injures someone else. It also offers legal protection in case of a lawsuit, up to the limit stated in your policy.

- Property Damage Liability: f you damage someone else’s property, such as their car or mailbox, this coverage helps cover the costs of repairs or replacements, up to the limit stated in your policy.

- Personal Injury Protection (PIP): PIP coverage assists in covering medical expenses and related costs if you or your passengers are injured in an accident. Even if you are not at fault, you may need to open a claim with us for medical expenses covered by your PIP coverage.

- Uninsured/Underinsured Motorist: This coverage protects you if you’re in an accident with a driver who doesn’t have insurance or has insufficient coverage to pay for the damages.

- Collision Coverage: If your vehicle is damaged in a collision with another vehicle or object, collision coverage helps pay for repairs or replacement.

- Comprehensive Coverage: This coverage pays for the repair or replacement of your vehicle if it’s damaged by something other than a collision, such as theft or vandalism.

It is important to note that the coverage limit sets a maximum amount that can be paid, but it does not guarantee full payment in every situation. Therefore, it is crucial to review and select coverage limits that align with your needs and potential risks. The amount of coverage you require depends on various factors, including your financial risk tolerance. We recommend discussing your coverage with your agent to ensure that you have the appropriate amount for your specific situation.

By understanding the different types of liability coverage and selecting appropriate coverage limits, you can have peace of mind knowing that you are adequately protected in case of unforeseen events. Your agent is available to provide guidance and assist you in making informed decisions about your coverage.

Your auto insurance policy typically extends coverage to you, your spouse/partner, relatives residing in your household, and other licensed drivers who have your permission to drive your insured vehicle. However, the specific details outlined in your contract with us and the underlying policy conditions dictate the exact coverage and exclusions.

If you have any uncertainties or inquiries regarding your coverage, we recommend reaching out to your agent. They are available to provide clarification and guidance tailored to your specific policy. In certain situations, your agent may even be able to make adjustments to your policy with minimal or no additional cost.

At Bear River Mutual, we understand the importance of knowing who is covered while driving your vehicle. Our team is here to support you in understanding your policy and ensuring that you have the appropriate coverage for your needs. Don’t hesitate to contact your agent for any questions or concerns you may have.

Rental coverage is an optional addition to your insurance policy and is not required by law. It is a vehicle-specific coverage that can be added to the specific vehicle(s) you request it for. To check if you have rental coverage, you can reach out to your agent or access your coverage details online through our Customer Site.

If you have rental coverage, it’s important to note that the amount of coverage depends on the limits you have selected. To ensure that your coverage meets your specific vehicle needs, it’s a good idea to discuss with your agent if your limits are appropriate.

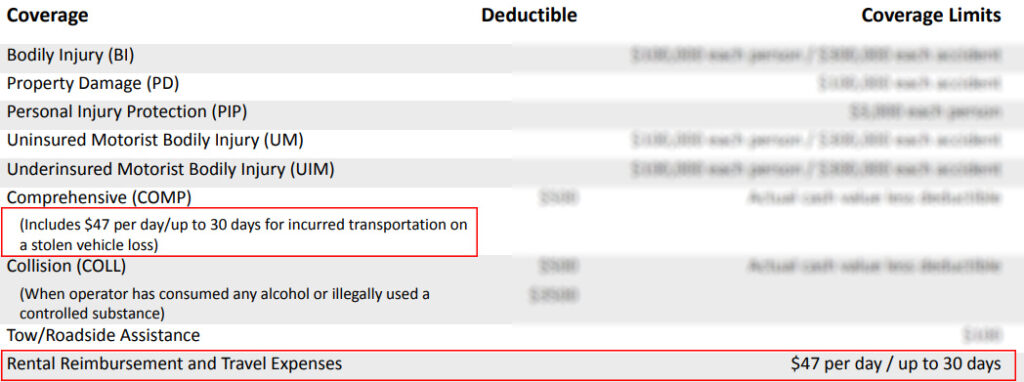

If rental coverage is included on your vehicle, you will find specific information on your policy document, known as the “AUTOMOBILE INSURANCE DECLARATIONS PAGE.” This page outlines the maximum rental charges allowed per day, up to a maximum of 30 days per covered claim. We have provided an image to help you locate this information easily.

It’s worth noting that rental days do not need to be consecutive. This flexibility can be beneficial in situations where your vehicle is drivable after initial repairs at the repair shop, but additional parts are still needed to complete the repairs. In such cases, you can utilize a rental car for the initial repairs, retrieve your vehicle once it is drivable, and then obtain a rental car again when the remaining parts arrive. By splitting the rental time, you increase the chances of not exceeding your rental coverage limits.

For accurate and detailed information about your rental coverage, we recommend consulting your agent or reviewing your policy documents. They will provide you with the specific details regarding rental coverage and answer any questions you may have.

Please don’t hesitate to contact your agent or refer to your policy documents to understand the specifics of your rental coverage. They are here to assist you and ensure that you have the necessary information to make informed decisions about your insurance coverage.

Claims – Auto

You have the freedom to choose the body shop that repairs your vehicle. We believe it’s important that you feel comfortable with your choice and never feel pressured. While the decision is ultimately yours, we highly recommend considering a Bear Care Direct Repair Program shop. This choice comes with numerous benefits that can greatly benefit you.

As a Bear River Mutual policyholder, you are covered not only in the United States but also in its territories and Canada. In the event of an accident, you have two options to start your claim: you can either initiate it online or call us at 801-267-5000 or toll-free at 800-925-5177 to speak with one of our representatives. Please make sure to gather the necessary information, including the car, insurance, and contact details of all parties involved in the accident. Once the claim is filed, an adjuster will reach out to you to guide you through the process and address any additional questions you may have. We’re here to assist you every step of the way

In the event that your vehicle is declared a total loss, Bear River Mutual will provide payment for the cash value of the covered loss, after deducting the applicable deductible. However, if there is still an outstanding loan balance on your vehicle, you will be responsible for settling that amount. To ensure that any remaining balance is covered, it is advisable to consider purchasing gap insurance. Your independent agent can provide you with various options and help you understand whether obtaining gap insurance is necessary in your situation. They are available to assist you in making an informed decision about protecting yourself from potential financial gaps.

Finding a trustworthy body shop to fix your car can be difficult and overwhelming. At Bear River Mutual, we want to make your auto insurance claims as easy and stress-free as possible. That’s why we have carefully chosen a group of auto repair shops that meet our high standards for quality and service. These shops are part of our Bear Care Direct Repair Program (DRP), and we guarantee the quality of their work. With us, you can have peace of mind knowing that your car is in good hands.

If the expense of repairing your vehicle surpasses its fair market value, taking into account its salvage value, we may classify it as a “total loss”. To determine the fair market value, an inspection will be conducted on your vehicle. If we assume ownership of the salvaged vehicle, you (or all titled owners and lienholders) will need to sign over the title to us. Payment will be issued upon reaching an agreement with you or the lienholder, depending on any outstanding loan balances. Rest assured, we will work closely with you throughout this process to ensure a fair and transparent resolution.

If your car is unable to be driven due to an accident or is undergoing repairs, the rental car coverage on your policy can provide you with a rental vehicle during this period. Simply reach out to your claims representative, and they will provide you with all the necessary details regarding any limitations that may apply. We are here to ensure that you have the information and support you need to secure a rental car while your vehicle is being taken care of.

As a Bear River Mutual policyholder, you can easily initiate the claims process online. Alternatively, you can contact your agent, or call our office at 801-267-5000 to speak with one of our dedicated customer care representatives. It’s important to gather the necessary information, including the details of the vehicles involved, insurance information, and contact information of all parties involved in the accident. Once the claim is filed, a claim representative will promptly reach out to guide you through the process and address any additional questions you may have. Rest assured, we are here to provide you with the support and assistance you need during this time.

While you have the freedom to select any shop for your car repairs, there are several compelling reasons why we highly recommend choosing a Bear Care Direct Repair auto body shop:

- Convenience: When you bring your damaged vehicle to a Bear Care Direct shop, there’s no need for a third-party appraisal. The required appraisal is pre-approved by Bear River Mutual, and the shop can schedule your repairs promptly. We handle all communication and issues directly, providing you with peace of mind and assurance that your car is in capable hands. With over 40 DRP shops throughout Utah, finding a nearby partner is convenient. Find one near you.

- Peace-of-Mind: Our DRP program shops guarantee their work for as long as you own your vehicle. However, if you choose a shop outside of our program, we cannot provide the same guarantee.

- Speed: Thanks to our established relationships with these shops, the repair process begins swiftly, ensuring that you get your vehicle back much sooner.

- Quality: We have meticulously measured and monitored the work of our DRP shops for many years, and they have earned our utmost trust and confidence. On average, customers who use a DRP shop report significantly higher satisfaction scores compared to those who do not.

- Efficiency: If additional damage is discovered during the repair process, it won’t cause delays. Our DRP shops are authorized to repair all accident-related damage they find, even beyond the initial estimate.

Claims – General

The time it takes to receive your insurance settlement payment can vary depending on the specifics of your claim. However, in most cases, once an agreed-upon cost or settlement has been reached, the payment process is typically initiated promptly. Rest assured that we strive to expedite the payment process as much as possible to ensure you receive your settlement in a timely manner. Our goal is to provide you with a smooth and efficient experience throughout the claims process.

Yes, even if you are not at fault, your deductible still applies. However, rest assured that once your claim is settled, we will assist you in recovering the deductible amount from the responsible party. The deductible will be subtracted from the total damages, and we will work diligently to ensure that you are reimbursed for this amount. Our goal is to minimize any financial burden on your part and provide you with the support you need during this process.

Determining the value of a claim involves the expertise and opinions of professionals, but it’s important to recognize that different experts may have varying perspectives on the necessary repairs and associated costs. If you have any concerns or disagreements regarding the settlement amount, please communicate your thoughts to your claims adjuster. They are there to listen and collaborate with you to reach a fair and accurate estimate that addresses your concerns. We are committed to ensuring that you are satisfied with the outcome, and we value your input throughout the claims process.

The timeframe for filing a claim may vary depending on the type of policy you have and the nature of the exposure. It is essential to review your policy documents to understand the specific timelines for filing a claim. We recommend contacting us as soon as possible to report your claim and discuss the applicable deadlines. Our team will guide you through the process and ensure that you meet all necessary requirements within the specified timeframe. Promptly reporting your claim is crucial to ensure a smooth and efficient claims experience.

If you find yourself facing a lawsuit from the other party involved in the incident, it is crucial to take immediate action. Contact your claims adjuster without delay, as there are specific deadlines for responding to a filed suit. They are experienced professionals who can guide you through the necessary steps and provide you with valuable advice on how to proceed. Your claims adjuster is here to support you during this process and ensure that you have the information and resources needed to address the lawsuit effectively.

It is highly recommended to file your claim as soon as possible following an incident. The earlier you initiate the claims process, the better it is for a prompt resolution. Ensure that you have all the necessary information readily available, including details of the vehicles involved, insurance information, and contact information of any other parties involved in the accident. By promptly submitting your claim, we can begin assessing the situation and providing the support and assistance you need without delay. Your satisfaction and a smooth claims experience are our top priorities.

Claims – Home

The decision of which contractor to use for your home repairs is entirely up to you. We want you to feel comfortable and confident in your choice, so you should never feel pressured to select a contractor that you are not comfortable with. While we highly recommend using a Bear Care Home Repair Program contractor due to the numerous benefits they offer, ultimately, the choice is yours. We believe in providing you with options and ensuring that you have the flexibility to choose the contractor that best suits your needs and preferences.

We understand that finding a reliable contractor to repair your home can be overwhelming. That’s why we have developed the Bear Care Home Repair program to simplify the process for you. This program provides access to a network of contractors who have been carefully vetted by Bear River Mutual to ensure they deliver exceptional service and repairs. These trusted contractors are part of our exclusive Bear Care Home Repair Program, and we stand behind their work with our guarantee. With this program, we aim to alleviate the uncertainty and stress often associated with home insurance claims, providing you with peace of mind and reliable assistance throughout the repair process.

Filing a Homeowner or Property claim is a straightforward process. You have two options to initiate the claims process:

- Online: You can begin the claims process conveniently online. Visit our website and follow the step-by-step instructions to submit your claim.

- Contact your agent: Your agent can start the claims process for you. One of our representatives will then reach out to go over any additional questions that you may have, and possibly ask you to provide additional information that can help the claims process proceed more smoothly.

- Contact our Representatives: If you prefer a more personal approach, you can reach out to one of our representatives directly at 801-267-5000. They will guide you through the claims process and address any questions or concerns you may have.

- Convenience: With a Bear Care Home Repair contractor, there’s no need for a separate appraisal process. When our approved contractor assesses the damage, the appraisal is pre-approved by Bear River Mutual, saving you time and hassle. They can schedule your repairs, and we handle all communication and issues directly with them. Rest assured that your home is in capable hands.

- Peace of Mind: Our Bear Care Home Repair program guarantees the work of our contractors for three years. If you choose your own contractor, we cannot guarantee their work. By opting for a Bear Care contractor, you can have confidence in the quality and reliability of the repairs.

- Speed: Our established relationships with these contractors facilitate quick communication and expedite the repair process. You can expect your home to be restored to its original state in a timely manner.

- Quality: We have closely monitored the work of our Bear Care Home contractors for many years, and they have earned our utmost trust and confidence. Customers who choose our preferred contractors consistently report higher satisfaction scores compared to those who do not.

- Efficiency: If additional damage is discovered during the repair process, it won’t cause delays in your repairs. Our Bear Care Home contractors are authorized to address all claim-related damage they encounter, even if it goes beyond the initial estimate. This ensures a comprehensive and efficient restoration of your home.

By utilizing a Bear Care Home Repair contractor, you can enjoy the convenience, peace of mind, speed, quality, and efficiency that come with our trusted network of professionals.

If your home has been damaged, we recommend taking the following steps:

- Ensure Safety: First and foremost, prioritize the safety of yourself and your family. If there are any immediate hazards, such as structural damage or electrical issues, evacuate the premises and seek professional assistance if needed.

- Consult Your Independent Agent: It may be beneficial to contact your independent agent for advice and guidance as you begin your claim. They can offer valuable insights and help you determine if filing a claim is the right course of action for your situation.

- Mitigate Further Damage: Providing you can do so safely, take necessary measures to prevent additional damage to your home. This may include actions such as covering exposed areas with tarps or boards, shutting off the water supply if there is a plumbing issue, or turning off the electricity if there is an electrical problem. These initial steps can help minimize the extent of the damage.

- Document the Damage: Once the situation is safe, document the damage by taking photographs or videos. This evidence will be valuable when filing your insurance claim.

- Contact Us: After ensuring safety and mitigating further damage, you can begin the claims process. You have two options:

- Online Claims Process: Visit our website to initiate your claim online. Follow the instructions provided to submit the necessary information and documentation.

- Contact our Representatives: If you prefer personalized assistance, you can reach out to one of our representatives directly at 801-267-5000. They will guide you through the claims process and address any questions or concerns you may have.

Remember, taking immediate action to mitigate further damage is crucial. Once you’ve ensured safety and documented the damage, contact us or initiate the online claims process to begin the necessary steps towards restoring your home.

Earthquake Insurance

Your independent Bear River Mutual agent can help you in obtaining this type of coverage for your property. While there may be certain underwriting guidelines that determine the availability of earthquake insurance, your agent can assist you during the process of obtaining a new policy quote or adding earthquake coverage after. They have the knowledge and expertise to guide you through the necessary steps and ensure that your property is adequately protected against earthquake damage.

Earthquake insurance operates differently compared to other insurance policies. Here’s how it typically works:

- Deductible: The deductible for earthquake policies is based on a percentage of the coverage amount for the structure (Coverage A) or personal property (Coverage C), whichever is greater. Check your homeowner policy for the specific deductible details.

- Coverage Threshold: Earthquake insurance only pays for damages that exceed the deductible. Any damages below the deductible amount are typically not covered.

- Separate Deductibles: Depending on your policy, there may be separate deductibles for different components such as contents, structure, and unattached structures like garages, sheds, driveways, or retaining walls.

It’s essential to review your policy and consult your independent agent for a comprehensive understanding of how earthquake insurance works and the specific deductible amounts for different aspects of coverage. They can provide the necessary information and answer any questions you may have.

Earthquake insurance is additional insurance for a specific risk type (earthquakes). It provides coverage in the event that your home is damaged by an earthquake. Unlike a standard homeowner policy, which does not cover earthquake damage, earthquake insurance steps in to protect your property.

Earthquake insurance may cover various aspects, including:

- Repairs to Your Home: If your home sustains damage from an earthquake, the insurance policy can help cover the costs of repairing the structural damage.

- Personal Property: Earthquake insurance also provides coverage for your personal belongings that may be damaged as a result of an earthquake.

- Debris Removal: In the aftermath of an earthquake, there is often a need to remove debris. Earthquake insurance can help cover the expenses associated with debris removal.

- Additional Living Expenses: If your home becomes uninhabitable due to earthquake damage and you need to live elsewhere temporarily, earthquake insurance can help cover the extra living expenses you may incur during this time.

It’s important to review the specific details of your coverage by referring to your official policy documents. For a better understanding of your coverage needs and policy details, your independent agent can provide valuable guidance and assistance.

General

We understand that circumstances may arise where you need to cancel your Bear River Mutual policy. While we’re sorry to see you go, we want to make the cancellation process as smooth as possible for you. Here’s what you need to do:

- Contact Your Agent: To initiate the cancellation of your policy, simply reach out to your independent Bear River Mutual agent. They will assist you in the cancellation process and take care of the necessary steps on your behalf.

By contacting your agent directly, you can ensure that all the required paperwork and procedures are handled correctly. They will guide you through the process, answer any questions you may have, and address any concerns that arise during the cancellation.

We appreciate your time as a policyholder and value your feedback. If there are any specific reasons for your cancellation, we would appreciate hearing from you so that we can continually improve our services.

Bear River Mutual has received an AM Best Rating of A- (Excellent). AM Best is the largest credit rating agency globally, specializing in evaluating the financial strength and stability of insurance companies.

The AM Best Rating is significant because it provides an objective assessment of an insurer’s ability to fulfill its obligations to policyholders. A higher rating indicates a stronger financial position and a greater likelihood of meeting claims and other policyholder needs.

Bear River Mutual’s A- (Excellent) rating reflects our commitment to financial stability and our ability to provide reliable coverage and service to our policyholders.

To stay up-to-date with the latest Best’s Credit Rating for Bear River Mutual, you can visit the AM Best website at www.ambest.com.

We believe that our AM Best Rating is a testament to our dedication to serving our policyholders and providing them with the peace of mind they deserve.

Home Insurance

Absolutely, you have the flexibility to modify the coverage amount for your home insurance. If you are making improvements to your home, such as adding an extension, finishing your basement, or upgrading any other part of your property, it is crucial to ensure that your coverage aligns with the new value of your home.

To make changes to your coverage amount, simply reach out to your agent. They are there to assist you throughout the process and can provide guidance on adjusting your coverage to reflect any updates or renovations that may impact the value of your home.

At Bear River Mutual, we understand that your home is a valuable asset, and it is important to protect it adequately. By regularly reviewing and adjusting your coverage amount, you can ensure that you have the appropriate level of protection in place.

We encourage you to contact your agent whenever you make changes to your home that might affect its value. They will work with you to update your coverage and ensure that you have peace of mind knowing that your home is adequately insured.

Yes, Bear River Mutual offers Buried Utility Line coverage, also known as Service Line coverage, as an optional addition to our homeowners policies. This endorsement provides coverage for various items, including:

- Underground piping: This includes water, sewage, and gas lines that are buried beneath the ground.

- Buried connections, valves, or equipment: Any underground components that are connected to or serve the underground piping, such as valves or equipment.

- Underground wires: Coverage extends to electrical cables, power lines, and communication or data wiring that are buried underground.

At Bear River Mutual, we understand the importance of protecting these critical components of your home’s infrastructure. Buried Utility Line coverage helps provide financial security in the event of unexpected damage or breakdowns to these essential systems.

To learn more about the specific details of our Buried Utility Line coverage, we encourage you to visit our website or reach out to your independent agent. They can provide you with comprehensive information about this coverage and other insurance options available from Bear River Mutual.

Yes, Bear River Mutual offers Equipment Breakdown coverage as an optional addition to our homeowners policies. This endorsement provides coverage for a wide range of items, including kitchen appliances, home entertainment equipment, and air-conditioning systems.

With Equipment Breakdown coverage from Bear River Mutual, you can have peace of mind knowing that unexpected breakdowns of important household equipment will be taken care of. This coverage helps protect you from the financial burden of repairing or replacing essential items in your home.

To learn more about the specifics of Equipment Breakdown coverage and how it can benefit you, we invite you to explore the detailed information about this option on our website or by contacting your agent about this, and other coverages, provided by Bear River Mutual. Our goal is to ensure that you have the necessary coverage to safeguard your home and belongings.

The choice of which insurance carrier to use is entirely yours. While a lender, realtor, or other party may offer recommendations, it is important to understand that they do not have the power to make this decision on your behalf.

At Bear River Mutual, we believe in empowering our customers to make their own choices when it comes to selecting an insurance carrier. We understand that finding the right insurance provider is a personal decision that should align with your specific needs and preferences.

While it is common for lenders or realtors to provide suggestions or guidance based on their own experiences, the final decision rests with you. We encourage you to thoroughly research and compare different insurance carriers to find the one that offers the best coverage, service, and value for your individual circumstances.

Remember, our knowledgeable team at Bear River Mutual is always here to assist you in making an informed decision. We can provide you with the necessary information and answer any questions you may have about our insurance products and services.

To receive a quote for homeowners insurance from Bear River Mutual, we recommend reaching out to one of our trusted independent agents. These agents are authorized to quote and sell Bear River Mutual insurance policies.

Finding an agent in your area is simple. By clicking on our agent search tool, you can easily locate an agency that represents Bear River Mutual near you. Our network of independent agents is dedicated to providing personalized service and helping you find the right coverage for your home.

When you connect with a Bear River Mutual agent, they will guide you through the quoting process, taking into account your specific needs and preferences. They will gather the necessary information to provide you with an accurate and tailored homeowners insurance quote.

At Bear River Mutual, we believe in the value of working with independent agents who understand the local market and can offer personalized advice. We encourage you to take advantage of this service and connect with an agent to receive a homeowners insurance quote that meets your requirements.

The amount of homeowners insurance coverage you require depends on various factors. Primarily, your coverage should be sufficient to cover the cost of rebuilding your home and replacing all your possessions in the event of a catastrophic event.

Calculating the appropriate coverage amount involves considering factors such as the size, construction, and features of your home, as well as the current costs of labor and materials in your area. It is essential to evaluate the replacement value of your home, rather than its market value.

Additionally, you should assess the value of your personal belongings, including furniture, appliances, electronics, and other possessions. Creating a comprehensive home inventory list can be helpful in determining the total value of your belongings.

At Bear River Mutual, we recommend consulting with one of our trusted independent agents to assist you in determining the appropriate coverage amount for your specific circumstances. They have the expertise to guide you through the process and ensure that you have the right level of protection for your home and possessions.

Remember, having adequate homeowners insurance coverage provides you with the peace of mind that comes from knowing you are financially protected in the face of unforeseen events.

While a home inventory list is not mandatory, it can be highly beneficial when determining the appropriate coverage levels for your insurance policy. Working alongside your agent, a home inventory list can help ensure that you have adequate protection for your belongings. It is a record that includes details like photographs and receipts, which can be invaluable in the event of a claim.

Having a comprehensive home inventory list allows you to accurately assess the value of your personal property and possessions. This information is crucial for determining the appropriate coverage limits to adequately protect your belongings.

It’s important to note that certain high-value items, such as jewelry or firearms, may have specific coverage limits. If you own unique or high-value personal property, it is advisable to discuss additional coverage options with your agent. They can provide guidance on how to protect these items adequately.

At Bear River Mutual, we understand the importance of safeguarding your belongings. We encourage you to have open and detailed conversations with your agent to ensure that your insurance policy provides sufficient coverage for your unique needs.

Homeowners insurance provides coverage for repairs or replacements to your home’s structure and belongings. It also offers protection if you are found liable for injuries to others or damage to their property.

Standard home insurance policies are designed to safeguard you against specific types of damage. These typically include events like fire, theft, vandalism, and certain natural disasters. However, it is important to note that coverage can vary depending on the specific policy.

At Bear River Mutual, we understand that every homeowner’s needs are unique. That’s why we offer the flexibility to customize your policy with additional coverage options to suit your individual circumstances. By working with your trusted independent Bear River Mutual agent, you can gain a deeper understanding of the coverage that best fits your needs.

Your independent agent will serve as a valuable resource, providing expert guidance and answering any questions you may have about homeowners insurance. They can help you assess the risks you face and recommend appropriate coverage options to ensure you have the protection you need.

With Bear River Mutual, you can have confidence that your home and belongings are safeguarded, giving you peace of mind knowing you are financially protected in case of unforeseen events.

Renters Insurance

It’s important to note that renters insurance policies generally provide coverage only for items owned by the policyholder. This means that your roommates’ belongings are typically not covered under your policy.

Each individual residing in your rental property should consider obtaining their own renters insurance policy to protect their personal belongings. This ensures that everyone has coverage tailored to their specific needs.

At Bear River Mutual, we encourage open communication with your roommates about the importance of renters insurance and the benefits it provides. By individually securing renters insurance, each person can have peace of mind knowing their personal belongings are protected in case of unexpected events like theft, fire, or other covered perils.

If you have any questions or need further clarification, we recommend consulting with one of our trusted independent agents. They can provide guidance and help you understand the best options for protecting your personal belongings and liability as a renter.

By taking proactive steps to secure renters insurance for yourself and encouraging your roommates to do the same, you can collectively ensure that everyone’s possessions are adequately protected.

To receive a quote for Renters Insurance from Bear River Mutual, we recommend reaching out to one of our trusted independent agents. These agents are authorized to quote and sell Bear River Mutual insurance policies, including Renters Insurance.

Obtaining a quote is simple. You can connect with any agency that represents Bear River Mutual to request a quote for Renters Insurance. Our network of independent agents is dedicated to providing personalized service and helping you find the right coverage for your rental property.

When you contact a Bear River Mutual agent, they will guide you through the quoting process, taking into account your specific needs and preferences. They will gather the necessary information to provide you with an accurate and tailored Renters Insurance quote.

At Bear River Mutual, we understand the importance of protecting your personal belongings and liability as a renter. We encourage you to take advantage of our independent agents’ expertise and reach out to them for a Renters Insurance quote that meets your requirements.

By working with a Bear River Mutual agent, you can have confidence that your rental property is adequately protected, giving you peace of mind knowing you are financially safeguarded in case of unforeseen events.

The amount of coverage you require for your renters insurance policy depends on the total value of your belongings in your rental unit. A helpful starting point is to create an inventory of all the items you own.

Taking inventory allows you to assess the value of your possessions and helps ensure you have adequate coverage to protect them. This includes items such as furniture, electronics, appliances, clothing, and other personal belongings.

To determine your specific coverage needs, we recommend consulting with your independent agent. They have the expertise to assess your situation, understand your unique requirements, and recommend the appropriate level of coverage.

Your independent agent will work closely with you to understand your belongings, evaluate potential risks, and guide you in selecting the right coverage options. They can provide valuable insights and answer any questions you may have, helping you make informed decisions about your renters insurance policy.

At Bear River Mutual, we are dedicated to ensuring you have the protection you need for your personal belongings. By working with your agent, you can have confidence that your renters insurance policy aligns with your specific needs, providing you with peace of mind and financial security.

If you are a policyholder with Bear River Mutual and need to file a renters insurance claim, we offer convenient options to assist you. You can easily file a claim online through our website. Additionally, you have the flexibility to contact your independent agent or reach out to us directly at 801-267-5000 to speak with one of our dedicated customer care representatives.

When faced with a situation that may require a claim, your independent agent can provide valuable guidance. They can help assess the situation and advise you on whether filing a claim is the best course of action based on the circumstances.

At Bear River Mutual, we understand the importance of a smooth claims process and are committed to providing exceptional customer service. Whether you choose to file a claim online or prefer to speak with a representative directly, we are here to assist you every step of the way.

Remember, your independent agent is a valuable resource who can help navigate the claims process and ensure you have the information and support you need. By working together, we can help resolve your renters insurance claim efficiently and effectively.

The cost of renters insurance premiums can vary and is determined by several factors. These factors include coverage limits, deductibles, and the location of your rental property.

To get an accurate price quote based on your specific needs and situation, we recommend reaching out to your independent agent. They have the expertise to assess your requirements and provide you with a personalized quote.

Your agent will take into account factors such as the value of your belongings, the level of coverage you desire, and any additional coverage options you may need. They can guide you through the process of selecting the appropriate coverage limits and deductible options that fit your budget and provide the necessary protection.

At Bear River Mutual, we understand the importance of finding affordable renters insurance that meets your needs. By working closely with your agent, you can obtain a quote that reflects your unique circumstances and ensures you have the right coverage in place.

Don’t hesitate to contact your independent agent to discuss your options and receive a price quote tailored to your specific needs. They are here to assist you in finding a renters insurance policy that offers the right level of protection at a price that fits your budget.

Renters liability insurance is designed to protect you in case you are found liable for damages caused by negligence. For example, if you accidentally leave the kitchen sink on and it overflows, causing damage to your neighbors’ apartment, you could be held responsible for the resulting expenses. This may include repairs, medical bills, and even legal defense costs if your neighbors decide to take legal action against you.

While renters liability insurance covers these specific costs, it is important to note that it does not provide coverage for other essential aspects of renters insurance, such as personal property, living expenses, and other important coverages.

It’s crucial to understand that liability insurance alone may not satisfy all the coverage requirements set by your landlord. They may also require you to have additional coverage for your personal belongings and other potential risks.

To ensure you meet your landlord’s requirements and have comprehensive protection, it is recommended to obtain a renters insurance policy that includes liability coverage along with coverage for personal property, living expenses, and other essential aspects.

By working closely with your independent agent, you can obtain a renters insurance policy that will meet your specific needs, including any requirements set by your landlord. They can help you understand the coverage options available and assist you in selecting the right policy that provides the necessary protection.

Renters insurance, also known as tenants insurance, is an insurance policy that offers similar benefits to homeowners insurance, with a few key differences. While homeowners insurance covers both the dwelling and its structure, renters insurance focuses primarily on providing coverage for the belongings and liability of the renter.

Renters insurance is designed specifically for individuals who rent their living space, such as apartments, condos, or houses. It offers financial protection in case of unforeseen events, such as theft, fire, or damage to personal property.

Unlike homeowners insurance, which covers the physical structure of the dwelling, renters insurance does not include coverage for the actual building or its structure. Instead, it primarily focuses on protecting your personal belongings and providing liability coverage.

With renters insurance, you can ensure that your personal possessions are safeguarded in case of unexpected incidents. This includes coverage for items such as furniture, electronics, clothing, and other belongings that you own.

Additionally, renters insurance often includes liability coverage, which protects you in case someone is injured on your rental property and holds you responsible. This coverage can help cover medical expenses, legal fees, and other costs associated with liability claims.

Renters insurance provides valuable protection for renters, offering peace of mind and financial security in case of unexpected events. It is an essential investment for tenants to ensure their belongings are protected and that they have coverage for potential liability issues.

Renters insurance provides a range of essential coverages to protect you and your belongings. A comprehensive renters insurance policy typically includes:

- Liability Coverage: This protects you if someone is injured on your rental property and holds you responsible for the incident. It can help cover medical expenses, legal fees, and other costs associated with liability claims.

- Personal Belongings Protection: Renters insurance safeguards your belongings in case of damage or theft. This includes coverage for items such as electronics, furniture, clothing, and other personal possessions. If your belongings are damaged or stolen, renters insurance can help cover the cost of repairing or replacing them, providing financial security.

- Additional Living Expenses: If your rented home becomes temporarily uninhabitable due to a covered event, renters insurance can help cover the costs of alternative accommodations, such as hotel stays or temporary rentals. This ensures that you have a place to stay while your home is being repaired or made livable again.

- Medical Expenses: Renters insurance may also provide coverage for certain medical expenses if someone is injured on your property. This coverage can help pay for medical bills and related expenses, offering protection and peace of mind.

For detailed information about the specific coverages included in your Bear River renters insurance policy, we recommend consulting with your independent Bear River Mutual agent. They have the expertise to explain the details of your policy and help you understand the extent of your coverage.

Your agent is your trusted resource for information, guidance, and personalized assistance in selecting the right renters insurance policy that meets your needs. They can provide you with a clear understanding of the coverages included in your policy, ensuring that you have the protection you require.

It is crucial to have renters insurance because the insurance typically provided by apartment complexes and landlords only covers damage to the physical structure of the dwelling itself. This means that your personal belongings, such as electronics, furniture, and clothing, remain vulnerable and unprotected.

To safeguard your possessions in the event of unforeseen circumstances like fire, theft, or damage, it is essential to have your own insurance policy known as an HO4 or renters insurance policy.

Renters insurance offers comprehensive coverage for your personal belongings, providing financial protection in case of unexpected events. If your belongings are damaged or stolen, renters insurance can help cover the cost of replacing or repairing them, ensuring that you are not left with a significant financial burden.

Additionally, renters insurance often includes liability coverage, which protects you if someone is injured at your residence and holds you responsible. This coverage can help cover medical expenses, legal fees, and other costs associated with liability claims.

By obtaining renters insurance, you can have peace of mind knowing that your belongings are protected and that you have coverage in place to handle potential liability issues. It is a wise investment that safeguards your financial well-being and provides security for your personal belongings.

Umbrella Insurance

To add umbrella insurance coverage to your current policy, there are a few requirements to consider. You must have both Home and Auto policies with Bear River Mutual, and these policies need to meet specific coverage levels.

If you meet these criteria and would like to add umbrella insurance to your coverage, simply reach out to your dedicated Bear River Mutual agent. They will assist you in the process of adding umbrella insurance to your policy.

Contacting your agent is the best way to request any additions or modifications to your policy. They have the knowledge and expertise to guide you through the necessary steps and ensure that your coverage is tailored to your specific needs.

Don’t hesitate to get in touch with your Bear River Mutual agent to discuss supplementing your existing coverage with an umbrella policy. They are here to provide you with personalized assistance and help you secure the additional protection you desire.

If you wish to increase your Umbrella Insurance coverage, Bear River Mutual provides umbrella coverage limits of $1,000,000 and $2,000,000. To make any changes to your policy and request an increase in coverage, simply get in touch with your dedicated Bear River Mutual agent.

Your agent is the best resource to assist you with modifying your policy to meet your specific needs. They can guide you through the process and help you understand the options available for increasing your Umbrella Insurance coverage.

Don’t hesitate to reach out to your Bear River Mutual agent to discuss your requirements and explore the possibilities for enhancing your coverage. They are there to provide you with personalized assistance and ensure you have the right level of protection in place.

The amount of umbrella insurance coverage you require can be determined by considering the assets you need to protect. It is essential to evaluate your specific circumstances and the potential risks you may face.

Bear River Mutual offers umbrella coverage limits of $1,000,000 and $2,000,000 to provide flexibility in choosing the appropriate coverage level for your needs.

To determine the right amount of coverage, consider factors such as the value of your assets, including your home, vehicles, investments, and savings. Also, take into account your potential liability risks, such as the likelihood of being involved in a lawsuit or facing significant financial claims.

It is advisable to consult with your Bear River Mutual agent to assess your individual situation and obtain expert guidance. They can help you evaluate your assets, assess your risk exposure, and recommend an appropriate coverage level.

Your agent will work with you to ensure that you have sufficient umbrella insurance coverage to protect your assets and provide you with peace of mind. They will consider your unique needs and budget to help you make an informed decision about the coverage level that best suits your requirements.

Umbrella insurance offers liability coverage that comes into effect when the coverage limits of your existing auto, home, or other insurance policies have been exhausted. Bear River Mutual provides umbrella policy limits of $1,000,000 and $2,000,000.

Here’s how umbrella insurance works: Let’s say you are involved in an automobile accident and are sued for $1,000,000 in damages. If your auto policy has a liability limit of $500,000, your umbrella policy would then come into play to cover the remaining $500,000.

Umbrella insurance acts as an additional layer of protection, filling the gap between the limits of your primary policies and the total amount of damages or claims you may face. It provides coverage for various liability situations, such as bodily injury, property damage, defamation, and more.

By having an umbrella policy in place, you can have peace of mind knowing that you have extra coverage to help safeguard your assets and protect you from potentially significant financial burdens resulting from lawsuits or serious claims.

To learn more about how umbrella insurance can work for you and to explore the coverage options available, reach out to your Bear River Mutual agent. They will provide you with the necessary information and help you understand how umbrella insurance can provide an added layer of security for your specific insurance needs.

All Bear River Mutual insurance policies, including umbrella insurance, are quoted and sold through independent agents.

Any agency that represents Bear River Mutual can quote umbrella insurance. These agents are knowledgeable about Bear River Mutual’s offerings and can assist you in finding the right coverage for your needs.

To obtain a quote, simply contact the independent agent that you purchased your other Bear River Mutual policies through. They will guide you through the process and gather the necessary information to provide you with an accurate quote for umbrella insurance.

Working with an independent agent offers the advantage of personalized service and access to multiple insurance options. They can compare quotes from different insurers and tailor a policy that fits your specific requirements.

Umbrella insurance provides additional coverage that can help safeguard your assets in the event of lawsuits and significant claims. It offers an extra layer of protection beyond the limits of your primary insurance policies.

There are several reasons why obtaining umbrella insurance may be beneficial:

- Asset Protection: Umbrella insurance is designed to protect your assets, such as your home, vehicles, savings, and investments. In the event of a lawsuit or substantial claim, umbrella insurance can help cover costs that exceed the limits of your underlying insurance policies, providing you with financial security.

- Liability Coverage: Umbrella insurance offers liability coverage that extends beyond the coverage limits of your primary policies, such as auto or homeowners insurance. This means that if you are held responsible for an accident or injury, umbrella insurance can help cover legal expenses, medical bills, and other costs associated with liability claims.

- Comprehensive Protection: Umbrella insurance provides broad protection against various risks and liabilities. It can cover a wide range of incidents, including property damage, bodily injury, defamation, libel, slander, and even certain personal injury claims.

To determine if umbrella insurance is right for you, it is recommended to consult with your agent at Bear River Mutual. They have the expertise to assess your specific needs, evaluate your risk exposure, and help you make an informed decision.

Your agent will take into account your assets, lifestyle, potential liabilities, and budget to determine if umbrella insurance is a suitable option for you. They can provide personalized advice and guidance to ensure you have the appropriate level of coverage to protect your assets and provide peace of mind.

Reach out to your Bear River Mutual agent to discuss the benefits of umbrella insurance and determine if it is the right choice for your insurance portfolio. They are here to assist you in making informed decisions and securing the protection you need.

Question: What does umbrella insurance cover?

Answer: Umbrella insurance is a type of coverage that provides additional protection for your assets. It serves as excess liability insurance, extending beyond the limits of your home, auto, or other liability policies.

Here’s how umbrella insurance works: In the event that you are held responsible for damages or face a significant liability claim, umbrella insurance steps in to provide coverage beyond what your primary policies offer. It acts as a safeguard to protect your assets from potential financial burdens resulting from lawsuits or substantial claims.

In addition to providing excess liability coverage, umbrella insurance may also offer primary insurance for certain losses that may not be covered by your home or auto insurance policies.

To determine if umbrella insurance is suitable for your specific needs, it is recommended to contact your Bear River Mutual agent. They have the expertise to evaluate your circumstances, assess your risk exposure, and provide personalized guidance.

Your agent will help you understand if umbrella insurance is the right choice for you, taking into account factors such as your assets, lifestyle, and potential liability risks. They can explain the coverage options available and assist you in making an informed decision.

Reach out to your Bear River Mutual agent to discuss umbrella insurance and discover how it can provide an extra layer of protection for your valuable assets. They are here to help you navigate the insurance landscape and find the coverage that best meets your needs.